The Paris Climate Agreement, signed in 2015 and entering into force on 4 November 2016, is a landmark in human history, as was the creation of the United Nations. The treaty is crucial because it is the first international agreement in a long time that, although not legally binding, is based on voluntary commitments and has been accepted by almost all countries worldwide. Perhaps only FIFA has more signatories and members.

Author: Szilárd Szélpál

Why is this treaty so interesting?

A global agreement was adopted that applies to all nations for the first time, without the largest countries blocking its adoption due to their national economic interests. The long-term goal of the Convention is to keep the global surface temperature rise below 2 degrees Celsius above pre-industrial levels. It also states that the limit should preferably be 1.5°C. These limits are set as a long-term average of global temperatures. The smaller the temperature rise, the less the impact of climate change. To achieve this, greenhouse gas emissions must be reduced as rapidly and as much as possible, reaching net zero emissions by the middle of the 21st century. To keep global warming below 1.5°C, emissions must be reduced by around 50% by 2030, considering individual country commitments. However, since the Paris Agreement was signed, global emissions have risen rather than fallen. 2024 was the warmest year on record, and global average temperatures have increased by more than 1.5°C.

How does this relate to the car industry?

You may remember the Diesel scandal and its economic impact. Dieselgate, or the diesel scandal, erupted in 2015 when it was revealed that the Volkswagen Group (VW) had manipulated emissions data for its diesel engines. The company used software that lowered emissions readings during official tests, while in real-world driving, the vehicles significantly exceeded legal limits. The scandal quickly spread to other carmakers and triggered a worldwide drive to tighten regulations and consumer mistrust of diesel engines.

Volkswagen faced substantial financial and legal consequences, paying more than €30 billion in fines, damages, and recall costs. The company has been hit with heavy penalties in the United States, but there have also been numerous lawsuits in Europe. After Dieselgate, several other car manufacturers, including Daimler and Fiat-Chrysler, were also investigated. However, the scale and consequences of the infringement were not always the same as in the case of Volkswagen.

The scandal has significantly impacted the diesel engine market, which has seen its share fall dramatically. While in 2015, half of all new cars in Europe were diesel, this share had fallen below 20% by 2022. At the same time, the take-up of electric cars has accelerated as car manufacturers move towards more sustainable technologies. Volkswagen, for example, has invested heavily in electric vehicles and is now one of the world’s leading e-car manufacturers. The industry’s transformation has been further fuelled by the introduction of increasingly stringent emissions regulations, which have made the development of internal combustion engines more difficult and expensive.

The scandal also hit financial markets hard. Volkswagen’s shares lost almost 40% of their value when the scandal broke, and it took the company a long time to recover its market position. Investor and consumer confidence have also been shaken as a result, with long-term implications for corporate governance and consumer protection regulations in the industry.

While the scandal has caused enormous financial and reputational damage to Volkswagen and other car manufacturers, the climate agreement has boosted emission reduction targets globally. Their combined effect has accelerated the uptake of electric cars, led to stricter regulations, and transformed consumer behavior, which has increasingly shifted towards sustainable transport solutions.

The signing of the 2015 Paris Climate Agreement significantly boosted the uptake of electric vehicles (EVs) in the US. The Obama administration’s climate policy has supported emission reduction targets, which has spurred the development and sales of cleaner technologies such as EVs. Demand for EVs then began to increase, thanks to government incentives and growing consumer awareness.

However, in 2017, Donald Trump announced that the US would withdraw from the Paris Climate Agreement, which finally became official in November 2020. According to many, the federal government’s loosening of environmental regulations and support for the fossil fuel industry has hindered the uptake of electric vehicles. This has temporarily slowed the growth of the EV market, although some factors have continued to drive sales. While some states, notably California, have introduced stricter emissions standards and EV subsidy programs that have helped the market, EV sales have grown slower during this period. Tesla, already a leader in the electric car market, saw sales stagnate. In contrast, other US manufacturers saw similar results even though General Motors and Ford started to expand their electric model ranges.

In January 2021, following Joe Biden’s election as President, the US rejoined the Paris Climate Agreement, boosting the EV market. The federal government focused on boosting electric transport and introduced several incentives, including tax breaks and direct subsidies for EV buyers and manufacturers.

At the same time, significant resources have also been invested in developing the national charging network, further increasing the attractiveness of electric cars. Car manufacturers have also responded: Tesla has remained a dominant player, while traditional manufacturers such as General Motors and Ford have emphasized electrification even more.

The US withdrawal from and return to the Paris Climate Agreement has created a volatile regulatory environment that has impacted the electric vehicle market. Although federal-level support temporarily declined under the Trump administration, the steady increase in EV sales (except for a brief period of stagnation) showed that market trends, consumer demand, and state-level regulations continued to drive the uptake of electric vehicles. Biden’s withdrawal from the climate agreement has given a new impetus to the industry and contributed to the US’ long-term emissions reduction and sustainable transport goals.

The Chinese miracle

At the same time, China’s long-term emissions reduction strategy is closely linked to the Paris Climate Agreement, which the country joined in 2015. The targets set by the Convention have encouraged the Chinese government to develop an ambitious environmental policy, one of the key elements of which is to reduce carbon emissions from the transport sector. As a result, in the following years, China increased state support for producing and selling new energy vehicles (NEVs), including electric, plug-in hybrid, and hydrogen cars.

To reduce emissions, China announced in 2020 that it aims to achieve carbon neutrality by 2060. This target included a phase-out of fossil energy use and a complete transformation of the transport sector. In the following years, the Chinese government introduced several regulatory and economic incentives to accelerate the uptake of electric vehicles. Through central and regional subsidies, substantial financial assistance was provided to purchase electric vehicles, thus reducing their price and increasing market demand. Although state subsidies have gradually been reduced, electric cars benefit from specific tax incentives and state support, particularly for developing charging infrastructure.

The government also introduced strict regulations for manufacturers, requiring them to produce an increasing proportion of low-emission vehicles. In 2017, a mandatory quota system was introduced, requiring manufacturers to dedicate a certain percentage of their vehicle sales to electric or plug-in hybrid models. The regulation was intended to encourage the industry to reduce fossil-based transport while allowing manufacturers to sell or buy emissions credits from other companies, thus regulating the market.

Infrastructure development has also been key to the uptake of NEVs. China mobilized considerable resources to build a nationwide charging network, which has become the world’s most extensive and fastest-growing electric charging network. Through government investment and private sector collaboration, tens of thousands of public and home charging stations have been set up, enabling convenient and fast charging of electric vehicles nationwide.

Government subsidies have created new opportunities for Chinese automotive companies to expand globally. Thanks to government assistance, manufacturers such as BYD, NIO, and XPeng have made significant progress, gaining market share both domestically and internationally. These companies have developed modern, competitive electric models that are becoming increasingly popular not only in China’s domestic market but also in Europe and other regions.

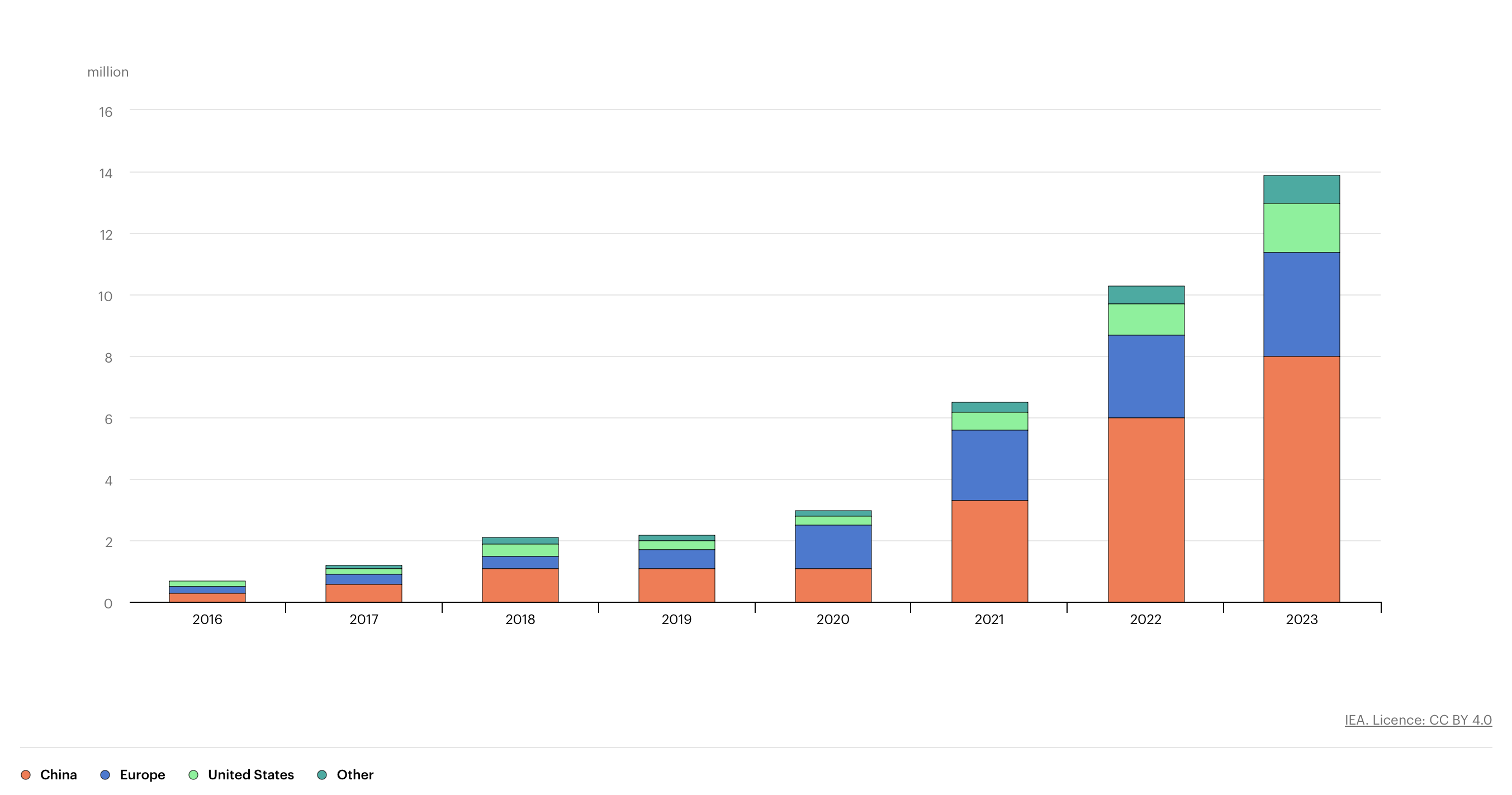

Sales of Chinese electric vehicles have been growing steadily in recent years. While in 2015, less than half a million NEVs were sold in the country, by 2018, this number had risen to more than one million, making China the world’s largest electric car market. By 2021, more than 3.5 million electric and plug-in hybrid vehicles had been sold, accounting for 15% of all new car sales.

China’s emission reduction strategy has, therefore, had a significant impact on the electric vehicle industry. The incentives provided by the Paris Climate Agreement, combined with targeted government support programs, have enabled the country to lead in developing and deploying sustainable transport solutions. The growth in electric car sales helps meet environmental targets and is also part of China’s industrial strategy to dominate the global vehicle market in the long term.

The US outlook

Donald Trump’s recent actions to withdraw the US from the Paris Climate Agreement and withdraw support for electric vehicles and renewables are expected to significantly impact domestic EV sales and US automakers’ global competitiveness.

Removing federal subsidies and eliminating tax incentives will increase the cost of EVs, which could reduce consumer demand in the US market. In addition, a freeze on public funding for the development of charging stations could slow the expansion of EV infrastructure, further hampering the uptake of electric cars. The relaxation of environmental regulations allows conventional combustion engine vehicles to become more competitive, which could further reduce interest in EVs in the US.

The 25% tariffs set to take effect on February 1, 2025, will significantly burden US automakers, particularly the Detroit-based manufacturers, which conduct a substantial portion of their production in these countries. The automotive supply chain is tightly intertwined in North America, so the cost of imported parts and vehicles is expected to increase production costs, which could lead to an increase in the price of new cars (by approximately $3,000). General Motors, Ford, and Stellantis could see their market share decline as rising prices put them at a competitive disadvantage against Asian and European manufacturers that do not face a similar tariff burden. In addition, the increase in manufacturing costs could reduce the profitability of Detroit firms and even lead to a fall in share prices in the short term, as investors may react negatively to a deterioration in the profit outlook. If demand falls due to higher prices, production cuts are also likely, leading to job losses and weakening US manufacturers’ long-term market position.

At the international level, these measures could threaten the global competitiveness of US automakers, especially at a time when Europe and China are further strengthening their electric mobility strategies. China, for example, is making significant investments in developing and producing electric vehicles while also becoming a world leader in renewable energies. In contrast, the withdrawal of US subsidies could disadvantage its own car manufacturers, as they will have less incentive to innovate and develop pure electric models.

This strategy could also be risky for investors and consumer confidence as the world moves towards sustainable transport solutions. While in the short term, oil and gas production could be boosted, in the long term, the US automotive industry could be left behind in the global EV race, where other countries, notably China and the EU, are steadily increasing their investment and market share.

Can the short-term positive financial and domestic policy effects counterbalance the expected longer-term adverse investor and global market trends for US automakers?

Cover photo credit: Envato

Szilárd Szélpál served as an environmental expert in the European Parliament from 2014, where he utilized his expertise to influence policy-making and promote sustainable practices across Europe. In addition to his environmental work, Szilárd has a deep understanding of foreign affairs, offering strategic advice and contributing to the development of policy initiatives in this field.